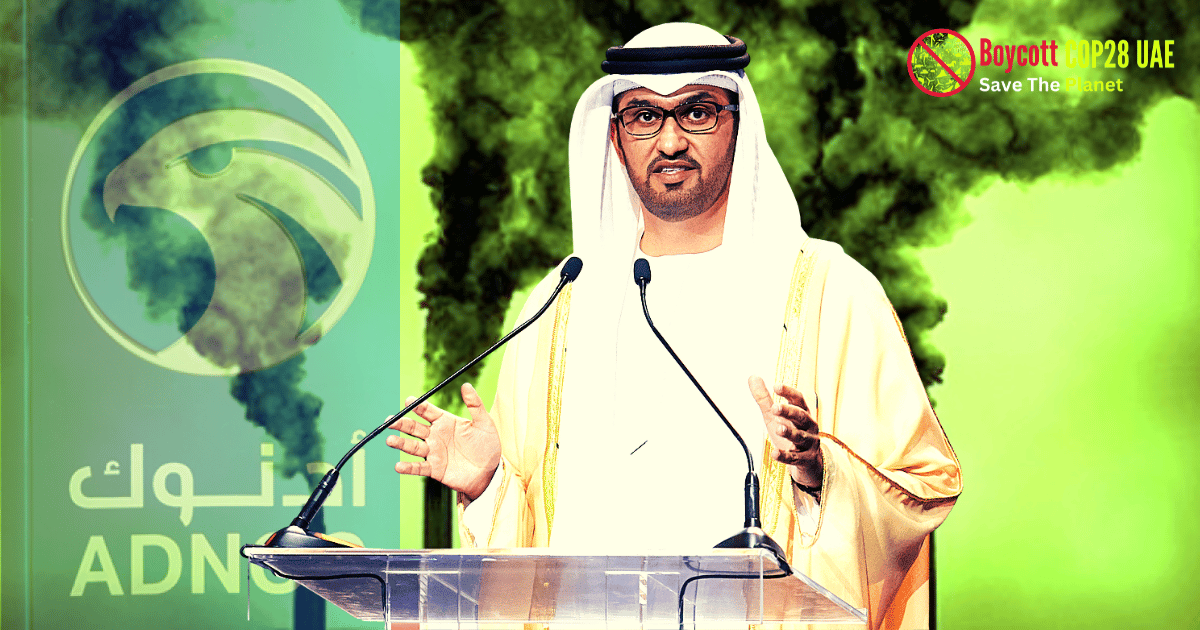

The appointment of Dr. Sultan Al Jaber, the CEO of the Abu Dhabi National Oil Company (ADNOC), as the president of the 28th Conference of the Parties (COP28) to be held in Dubai, has raised concerns about the United Arab Emirates’ (UAE) commitment to addressing climate change. The contradiction lies in the fact that ADNOC is one of the largest oil and gas companies in the Middle East and has announced plans to expand oil and gas production capacity with a $150 billion investment over the next few years. This article will delve deeper into the UAE’s intentions behind the appointment and the reasons for the contradiction.

The UAE’s COP28 President and his Climate Change Goals

During a speech at the Abu Dhabi International Petroleum Exhibition Conference (ADIPEC), Dr. Sultan Al Jaber emphasized the importance of maximizing energy while minimizing emissions to ensure global energy security. His comments seem to indicate that the UAE is committed to reducing emissions and transitioning to cleaner energy sources. However, this statement seems to be contradicted by the recent announcement by ADNOC of a $150 billion investment to expand oil and gas production capacity. The investment plan will raise crude output capacity to 5 million barrels per day by 2027, earlier than the previous target of 2030.

Furthermore, during his address at CERAweek, Dr. Sultan Al Jaber called for a 7% emissions cut and a swifter energy transition. However, ADNOC’s capital spending plan for 2022-2026, which was also announced recently, contradicts this goal. The state-owned company plans to invest $127 billion over the next five years to expand upstream production capacity and its downstream portfolio, among other things.

The UAE’s Climate Goals and ADNOC’s Investment Plans

The UAE shows to world that It is committed to reaching net-zero carbon emissions by 2050. However, its investment plans in the oil and gas sector suggest otherwise. While the country has made efforts to diversify its economy and reduce its reliance on oil, the recent investment plans by ADNOC suggest that the country still sees oil and gas as a key driver of its economy.

The UAE is the largest producer in the Organization of Petroleum Exporting Countries (OPEC) after Saudi Arabia and Iraq. The country’s push to expand its oil and gas production capacity comes at a time when oil prices have been volatile, driven in part by Russia’s invasion of Ukraine. While Brent crude has fallen back to near where it started the year, it climbed to more than $100 a barrel in February.

The investment plan includes a new unit for gas processing and marketing, called ADNOC Gas. The company plans to sell a minority share of the business through an initial public offering in Abu Dhabi in 2023. The government-owned ADNOC will also set up a separate arm to look at international expansion in gas, chemicals, and new energy sources.

Conclusion

The appointment of Dr. Sultan Al Jaber, the CEO of ADNOC, as the president of COP28 has raised questions about the UAE’s commitment to addressing climate change. The contradiction lies in the fact that the country plans to expand its oil and gas production capacity with a $150 billion investment while also committing to reaching net-zero carbon emissions by 2050. While the UAE has made efforts to diversify its economy and reduce its reliance on oil, the recent investment plans by ADNOC suggest that the country still sees oil and gas as a key driver of its economy. It remains to be seen how the country will balance its commitment to climate change with its investment plans in the oil and gas sector.